If you’ve ever invested in stocks, traded forex or dabbled in cryptocurrencies, you’ll know how difficult it is to make money and keep it.

There are so many factors that affect financial markets, so it isn’t easy to predict how they’ll move.

For example:

- China tightened regulatory pressure on crypto exchanges in 2017, causing Bitcoin to fall by 7%. But in 2018, a similar stance didn’t affect the market, and it finished up 4% on the day.

- Financial crises, like the housing crisis of 2008, also cause substantial market swings. In this case, the Dow dropped by 54%. Who could’ve predicted such a significant drawdown?

These aren’t isolated events either. A simple Google search will give you countless examples.

Situations like these cause investors to deviate from their strategies and act on emotion—buying high and selling low.

But how can you protect yourself from this volatility?

If you do it right, P2P (Peer-to-Peer) lending may be the solution to making a profit from investing and protecting it.

What is P2P Lending?

P2P lending—also known as crowd-lending—matches borrowers with investors rather than traditional lenders. This structure gives borrowers easier access to capital and better terms than typical lending options. P2P lending can enable better interest rates, lower loan-to-value ratios (meaning investors aren’t overleveraged) and more. Plus, it gives investors a unique opportunity to grow their wealth like a bank.

As an investor, you receive loan repayments each month, including interest. However, some platforms only release your initial investment at the end of the loan period.

P2P lending is an attractive option for investors thanks to the following benefits:

- The potential for double-digit returns with high-risk loans, beating typical stock returns.

- Lower volatility than stocks, forex and crypto since loans aren’t a traded product, meaning less emotional involvement.

- Passive returns in the form of loan repayments, freeing up your time for enjoying life.

While the initial structure focused on individuals, more institutional investors (with more leverage) and borrowers have come on board.

As a result, individual investors could face more challenges than in the past, including:

- Minimum investment amounts of more than £10,000 and annual income criteria.

- Difficulty finding opportunities before professional investors.

- Lower interest rates due to competition.

But it’s very much possible to become a successful investor at the individual level. In the next sections, you’ll learn everything you need to know about P2P lending.

What are the Risks of P2P Lending?

Double-digit returns with low volatility is every investor’s dream come true. However, there are some risks that you must be aware of, including:

- Borrowers who can’t pay back their loans and default.

- Collateral might not be liquidated at the expected value.

- Lack of loan diversification.

- Inexperience in P2P lending, leading to mistakes.

So before you start planning your retirement, make sure you have a plan to navigate these underwater rocks.

Loan defaults

Like investing in stocks that don’t perform as you expect, you might invest in borrowers who don’t pay back their loans.

We call these loan defaults.

P2P marketplaces grade borrowers against their lending criteria, putting them into categories from low-risk to high-risk. The higher the risk, the more interest you’ll get from the investment, but you’ll also have a higher chance of losing money.

While low-risk borrowers have great credit history (for unsecured personal loans) or enough collateral (for business loans, e.g., property development).

Most lending platforms have safeguards to prevent defaults, but it’s impossible to avoid 100% of them. And if there are too many defaults, your chosen P2P platform also has the risk of closing down. So, it’s really important to research your platform of choice well.

Lack of Diversification

Diversification lowers the risks of investing by spreading out your capital. So if a borrower defaults on a loan, the interest from your other investments covers it.

That’s why some lending platforms offer portfolios rather than individual loans. These portfolios give you exposure to hundreds or thousands of borrowers in one investment, so your risk of losing money is lower.

However, diversification isn’t only about the number of loans themselves. It’s also essential to spread your investments across loan types, platforms, etc.

So while P2P investors may think they’re well-diversified, the whole picture may tell a different story.

Investing Inexperience

Investing is not easy. That’s why we have dedicated careers and industries for different capital markets.

To become a successful P2P investor, you’ll need to know:

- Which loans are best for your investing profile.

- How much risk you can handle, i.e. how much money you’re willing to lose at any one time.

- How long you can invest.

- Whether you can achieve better returns than using a professional service.

- Which platforms are reputable?

- What the platform’s processes are for defaults and risk assessment.

- How each type of loan works—real estate and personal loans are not the same.

As you can see, becoming a successful P2P investor takes more than choosing the loans with the highest return.

Don’t worry, though. We’ve got you covered below.

How to Invest in P2P Loans

Since most platforms have different signup processes, we’ll let you figure that part out.

Instead, here are some crucial tips to keep in mind while investing in P2P lending:

1. Reinvest your earnings as often as possible.

Compound interest is a powerful ally for growing your money because each time you reinvest your earnings, you get a slightly larger return.

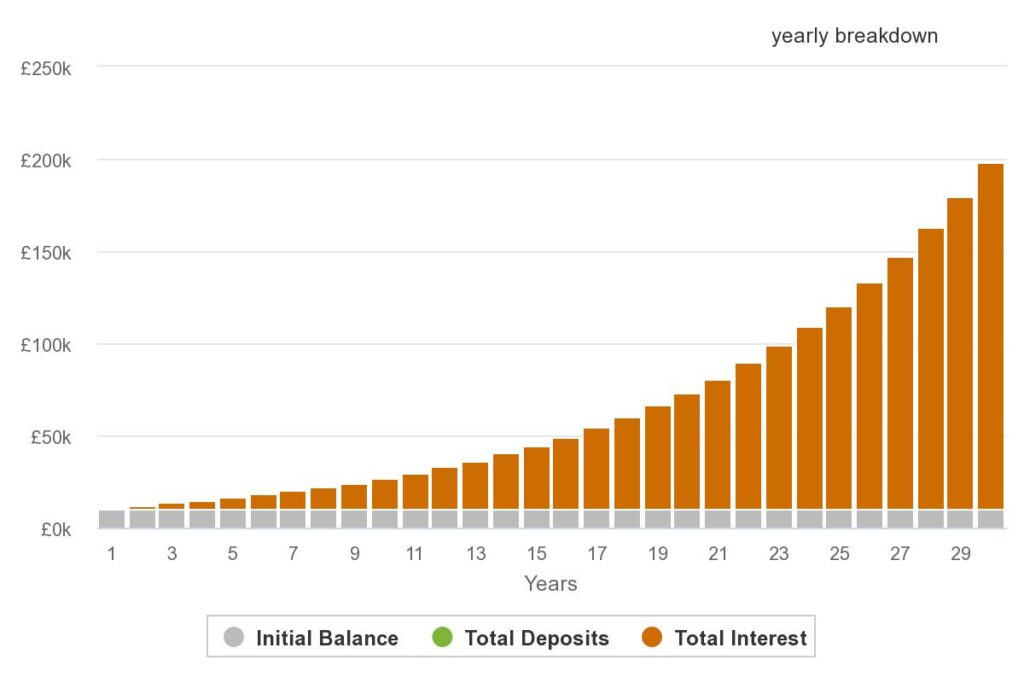

Example: £10,000 invested – 10% annual return, 10 years

Over ten years, the gap may not seem substantial. However, it gets even larger over a longer horizon as your returns grow exponentially.

Example: £10,000 invested – 10% annual return, 30 years

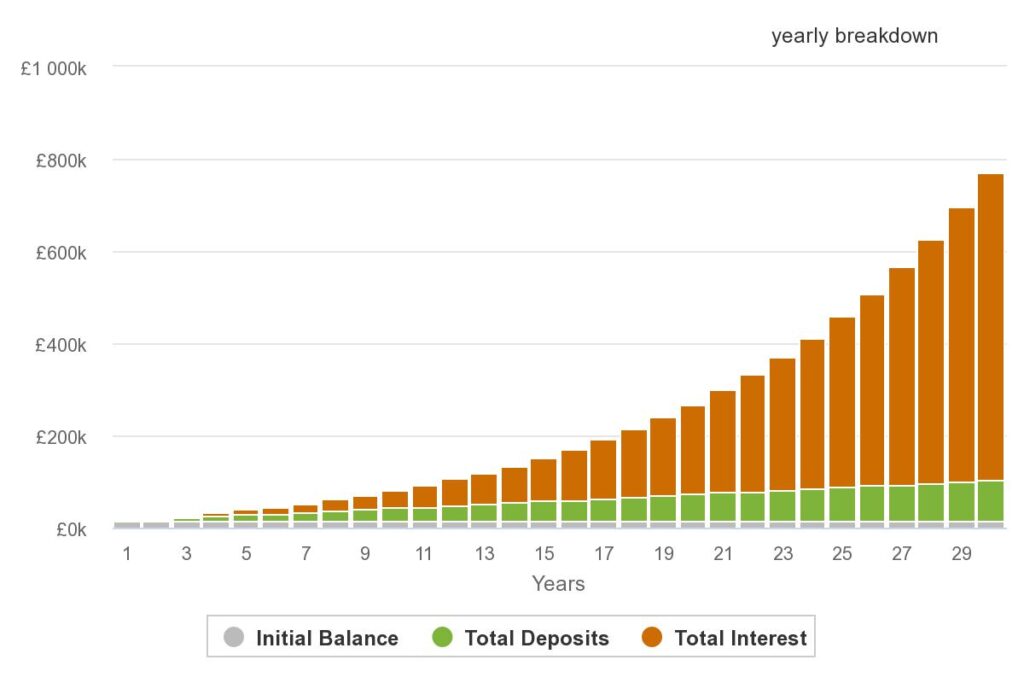

Now imagine adding £250 each month.

Example: £10,000 initial investment – £ 250 more invested each month – 10% annual return – 30 years

Keep in mind that each payment to you could decrease the return you receive since the loan amount is becoming smaller. So it’s important to reinvest if you want to maximise your earnings.

2. Choose a platform that protects you during defaults.

Defaults will always happen with P2P lending as life, business and investing are unpredictable. That’s why P2P lending platforms should have protections to reduce default impact.

The goods news is most platforms have either:

- Loan originator (businesses who source the loans) buybacks.

- Secure loans with collateral, e.g. car, savings, real estate, etc.

- Emergency funds.

Whichever method your platform uses, ensure that you understand how the process works when a borrower defaults.

3. Use a platform with transparent data.

Transparent data is crucial as it helps you make better decisions.

Here’s some information that’s helpful:

- Borrower data like loan-to-value and debt-to-income ratios, loan purposes and credit scores.

- Historical returns.

- Withdrawal and payment processes.

- How platforms vet their borrowers and deal with defaults.

- Registration and regulatory information.

4. Ensure that your investments are diversified.

As you know, a lack of diversification can impact your returns.

That’s why you should diversify your investments across:

- Several lending platforms.

- Different types of loans, e.g. Personal, real estate, business.

- High- and low-risk loans.

- Borrower demographics (age, job, location, etc.)

5. Assess the experience of directors and management staff.

Since these people control the platform’s operation, they must know what they’re doing.

You want to consider:

- Their previous professional experience and qualifications.

- The number of projects they’re involved in.

- Their attitude towards risk assessments and borrowers.

- Any future goals and plans they have for the platform.

6. Consider default rates for each risk level.

While historical default rates won’t guarantee what happens in the future, they give you an idea of what to expect.

Plus, they’re crucial for calculating accurate expected returns. After all, the advertised return isn’t guaranteed.

You can determine your actual return by calculating your estimated return – expected losses from defaults.

7. Aim to invest in portfolios rather than individual loans

Investing in individual loans is a tedious process. You’ll need to find at least 100 high-quality loans to invest in and reinvest profits each month—more if you want added protection.

To achieve this diversification, you’ll likely need to invest a few thousand pounds—which isn’t always suitable.

However, you can skip the diversification process by investing in a portfolio. Portfolios or pooled funds give you access to thousands of loans in one place—even if you have a small investing account and limited time.

This strategy does take away some of your control. But if you trust the portfolio manager’s analysis, returns will align with expectations. Plus, you’ll save a tonne of research time.

How to Maximise Your Chances of Investing Success

There’s no doubt that maximising P2P investing success requires hard work.

Assessing platforms, choosing investments and diversifying your portfolio take time and skill. And if you’re investing on a smaller scale, all the time spent staring at your screen may be worth a few cents per hour in the end.

But there is a solution.

At SAVI, we know that you don’t want to waste your spare time worrying about investments. But if you’re not investing, inflation reduces the value of your hard-earned money every day.

That’s why we’re creating a platform where you can:

- Automate saving and investing so you can focus on enjoying life.

- Let a team of professionals take care of all the risks and vetting—we live and breathe P2P lending.

- Leverage our loan network with exclusive investment terms.

- Easily track your investment from a simple mobile app.

So if you’re ready to #BeTheBANK, you can pre-register and be the first to know everything that’s coming for SAVI.