Tired of getting near-zero interest on your savings? Stick around and we will reveal some alternatives and exactly what we are working on at Savi.

This is the first blog post and I’m going to show you how the upcoming Savi app will solve near-zero interest on savings. I will take you through the simplified reasons behind this unprecedented beatdown on interest rates. I will then share some forecast and expectations, before revealing some solutions for your savings and the 10% ROI historic auto-pilot offer that Savi is now building.

Why the banks nowadays offer ZERO, near-zero or negative interest on your savings?

In its most simple terms, DEBT IS GETTING OUT OF CONTROL.

It’s both OK and NOT OK, but it’s definitely not sustainable.

It’s OK because central banks, usually alongside a democratic vote, can raise the debt ceiling and borrow more to sustain the economy. We all enjoy stability, money in our pockets, inflation and the full cycle repeating, getting us better prepared for the next crisis.

It’s NOT OK because taxpayers need to pay more and more, relative to their income, to sustain the country’s debt and their lifestyle. Don’t get me wrong, it’s not that bad, but it will likely break, and this will likely happen due to the natural effect this brings – the income inequality gap.

Interest rates & debt history in a few charts

Euro Area Interest Rates

source: tradingeconomics.com

European Union Government Debt

source: tradingeconomics.com

Forecast: Is interest on savings deposits expected to rise?

Things are not likely to change much.

Interest rates are forecasted to remain relatively steady throughout the rest of 2021 to 2023, meaning record low.

The EU projections highlight that “Inflation is expected to spike at 1.9% in 2021, reflecting temporary factors, before returning to 1.5% and 1.4% in 2022 and 2023.” This is 50% below what the economics textbooks say; 3% inflation = stability.

On a global level, keeping record low interest rates for the next few years means that the banks won’t need your savings deposits that much. If they do, the yield on term deposits will go up. Your bank will only offer better terms for your savings account if they can lend your money at good terms.

Who loses and who wins?

It’s up to you.

Stay vigilant and keep learning, and you will discover the best ways to make your money work for you.

Then, share this experience with everyone!

This is why we are creating Savi, so we can share our experience on selecting different investment opportunities that beat inflation with minimal risk.

Why people keep depositing their money in the bank?

It’s just how we are used to doing things. From the bank account history that your creditor, employer or landlord wants to see, to the feeling of safety knowing your bank’s branch is around the corner.

It’s also pretty much convenient – take cash out at ATMs everywhere or tap-pay for all your purchases.

BUT depositing money in the bank usually means a payment account, attached to a debit card, which pays ZERO interest.

It’s just for the convenience of “being used to it.”

Investments are usually non-liquid.

This makes investment not suitable for people who keep money in the bank. If investment is liquid, think stocks or Forex, then it’s a high-risk investment.

People need their money available, to pay, spend, … feast.

Our ultimate goal is to offer a solution that helps people save, invest with low risk and have access to all funds, on demand.

What are the current solutions?

There are many easily available alternatives to keeping your money in the bank – Binance or CoinDesk, Revolut or Robinhood, eToro or Interactive Brokers, … all the forex platforms.

Investing in real-estate is also a solution to protect your money from inflation, but things could offset quickly if you need to sell for the cash.

Investing in crowdfunded loans is a considerable alternative. The platforms you discover will point out to over 10% historic return on investment. And they have secondary markets where you can sell your investment, if you need cash. All you need to do is spend hours and hours on due diligence every time you invest.

The above solutions are far from all solutions, but you can notice they are either easy and risky or time-consuming and effective.

Savi aims to become the go-to solution for people who want the simplest way to save and invest their money.

Savi began as an idea for solving near-zero interest on savings.

It simply does not make financial sense to get 0.25% interest, while your bank lends money out for 5%-10%-15%.

This is classic finance.

The European Union just passed the Crowdfunding Directive in the end of 2020. This means that each one of us can now officially invest in loans via p2p lending platforms, essentially becoming like the bank – a credit originator.

Very soon, Savi will let you auto-save, auto-invest and spend money with a card or phone straight out of your investment balance.

We aim to offer you a saving and investment app that feels like a bank account while your money is invested in crowdfunded loans and yet, available for withdrawal on demand.

Why the world needs Savi now?

The effects of the latest financial crisis and the following economic stimulus still make waves through society.

Interest rates on savings accounts are record low, and even if they go up, they will still lose to inflation.

Keeping your money in the bank is safe, but it doesn’t make financial sense with near-zero interest.

Saving and budgeting is hard when using cash or paying with a card.

Investment is even harder with over 80% of non-professional investors losing their money in trades.

Crowdfunding was just regulated by the EU Crowdfunding Directive.

We set on a mission to work out a solution out of your money problems as a consumer.

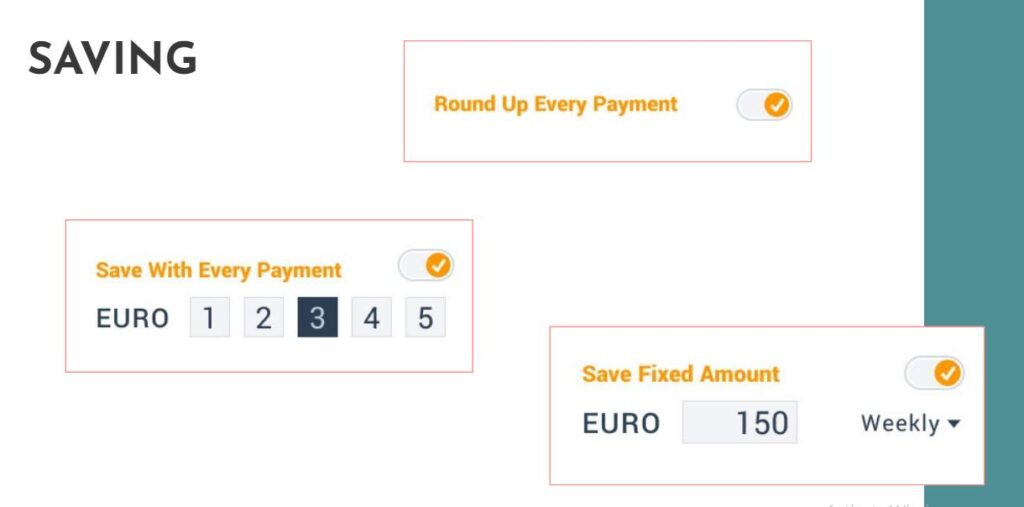

First, we set on a course to create an app that helps you auto-save.

Depending on whether you have a strict budget strategy or you want to just save spare change, we thought one app can easily do it for you.

All you need to do is to pay with your connected debit card account and set a few switches on.

Savi not only wanted to help people take over-spending habits under control, but we also wanted to make these savings work better than sitting in a term deposit with your bank, yielding 0.025%, if that.

We set away on a quest to let you save the way you want, connect all your accounts in one app, stay protected from over-saving and automatically invest in crowdfunding.

Good saving habits and tools on their own are not sufficient in protecting the value of your money.

This is when we started looking at:

Crowdfunding as an investment opportunity for regular people

Investing in crowdfunded loans for people and businesses historically brings over 10% return, as noticeable in any of the crowdfunding platforms out there.

The space is new, it’s diversified in terms of loan types and platform providers.

It has the potential to be a safe investment and a money-maker for people who don’t like keeping money in a savings account and losing to inflation.

We saw a gap and opportunity to make people’s savings work better – we could get them invested in crowdfunded loans for other people and businesses.

The crowdfunding space was just regulated in Europe at the end of 2020.

Beyond regulations, crowdfunding loans are usually backed by a mortgage, other property, or by a buy-back guarantee by a credit originator in the cases of investing in unsecured personal loans.

Making everything work together

This is how the Savi journey began.

We set to figure our the least friction way to automate your saving, no matter which bank’s debit card you use, and automate investing in crowdfunding – making it finally available to the crowds.

This journey starts with you onboard!